It started with the SEC’s MCDC initiative and Cease and Desist Orders, then it was the resulting enhanced scrutiny of underwriters and now it’s amendments to Rule 15c2-12. Each has further emphasized the importance of ensuring a complete understanding and management of disclosure obligations and having comprehensive polices and procedures.

The amendments to Rule 15c2-12 have refocused the spotlight on issuers and their policies, procedures and controls as well as their filing history and ongoing disclosure management. Our full article (link below) highlights what the market has learned since the MCDC initiative, discusses the Rule 15c2-12 amendments and identifies several resources for your consideration.

Read More

Topics:

Legislation, Politics and the Bond Market,

Government and Industry Regulatory News

With the cold winter air hanging around, the early months of the year can often be a time of winter blues. For some municipal debt issuers, it may also be a time of continuing disclosure filing blues. We often hear that there are many pieces of information to track when preparing a filing and, even after filings are made, there is still the worry that something was missed. For example, we have seen situations where a filing was made but was not filed to all the necessary CUSIPs. Or, a financial filing did not contain all of the information that the issuer committed to provide in the Continuing Disclosure Agreement. According to the GFOA Information on Best Practices for Disclosure, even when another firm is hired to prepare and/or submit filings on behalf of the municipal issuer, "Disclosure is the responsibility of the issuer. Others may assist in preparation but the issuer is ultimately responsible for completeness and accuracy."

Read More

Topics:

Legislation, Politics and the Bond Market,

Government and Industry Regulatory News

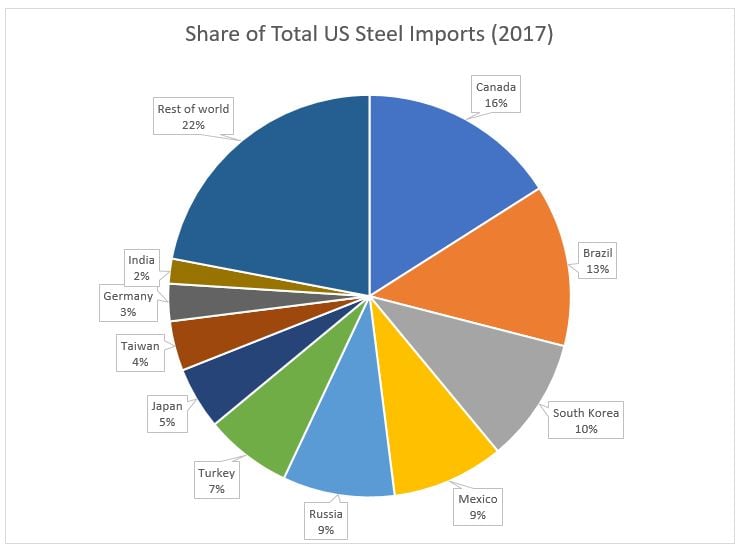

This week we take a closer look at President Trump’s recent imposition of tariffs and the potential impact on exporting states and key industries.

On Thursday, March 8, President Trump signed proclamations imposing a 25% tariff on steel and a 10% tariff on aluminum which, at least temporarily, exempted NAFTA partners Canada and Mexico. The tariffs are slated to begin 15 days from the signing. This action by President Trump follows his campaign promises to implement a more protectionist trading regime (or put America first – political perspective dependent), a topic Lumesis’ Eli Molin explored just prior to the President’s inauguration. As the administration implements these tariffs and continues to renegotiate NAFTA , we will update Eli’s piece with new data and a refined focus as the specificity of the tariffs become more apparent.

Read More

Topics:

Geo Scores: The Changing Economic Health of US Mun,

Legislation, Politics and the Bond Market,

Commentary

Last week, while everyone else was distracted by the NBA Finals, the Stanley Cup and James Comey, the rest of us in Muniland were on the edge of our seats during President Trump’s “Infrastructure Week.” During the campaign, President Trump proposed a $1 trillion plan to repair the nation’s infrastructure. Five months into his presidency, and having as many major legislative achievements as Patrick Ewing has championship rings,[1] we thought “Infrastructure Week” would be a great chance for the President to offer more details on the one issue with bipartisan support in Washington these days.

Read More

Topics:

Financial and Demographic Trends Affecting the Mun,

Legislation, Politics and the Bond Market,

Commentary

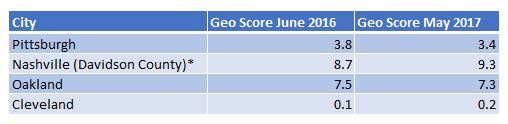

This week we bring you the February 2017 DIVER Geo Scores and, in case you missed it, some interesting news and a quote around the Labor Department’s Fiduciary Rule. Last month, a reader requested that we provide, in addition to the locations with the greatest moves, the top and bottom States, counties and cities. Given our limited space, we refer you to our website for that data.

Read More

Topics:

Geo Scores: The Changing Economic Health of US Mun,

Legislation, Politics and the Bond Market,

Government and Industry Regulatory News,

Commentary

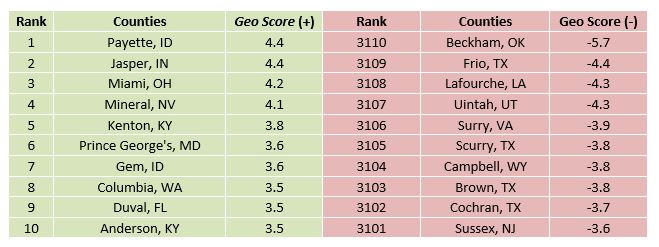

This week we look at the recently released MSRB report regarding disclosure filings and offer some facts and observations. We also look at those obligors that might be impacted should the Oroville Dam fail.

Read More

Topics:

Geography, Energy and Climate,

Legislation, Politics and the Bond Market,

Government and Industry Regulatory News,

Commentary

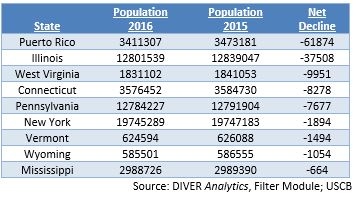

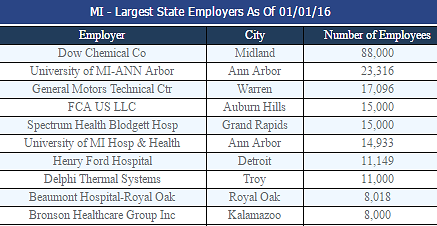

With so much attention on job growth from both the outgoing and new administrations, we thought it would be interesting to take a look at what the data, through the end of 2016, tells us about the employment situation relative to our population. Unlike politicians, we do not seek to cast credit or blame, nor do we seek to see if one party or the other is offering “alternative facts.” Our objective is to offer some observations that can be relevant to those focused on the municipal bond market, and how changes to our population and employment situation may impact municipal credits. As for conclusions, as with our politicians, it is up to you to decide which data points and combinations thereof provide you with the “real” vs. “alternative” facts. I do offer some of my perspective throughout. Due to the number of tables, this commentary will print a bit longer than usual.

Read More

Topics:

Financial and Demographic Trends Affecting the Mun,

Legislation, Politics and the Bond Market,

Commentary

This week we look at how State GDP (and therefore employment and tax receipts) may be impacted should certain campaign promises be kept. As we prepare for the inauguration of President-Elect Donald Trump, thankfully we have been spared “fighting in the streets.”[1] However, municipal market participants are bracing for uncertainty as the Trump administration and the newly elected Congress begin the process of implementing policy ideas promised during the campaign such as repealing the Affordable Care Act and increasing infrastructure spending.

Read More

Topics:

Legislation, Politics and the Bond Market,

Commentary