Given many recent positive economic indicators, one might conclude that we are well beyond the housing bubble that shocked the markets in 2008. College graduates from the class of 2017 are most likely settling down in their newly acquired jobs and, unlike many of their slightly older peers, living independently and free of the fear of Mom and/or Dad harping “Just get a job!”

Sue Childs

Recent Posts

As March Madness 2017 predictions abounded, so too did predictions about the timing of the next increase in the Fed Funds rate and how many would take place over the course of 2017. The increase in the Fed Funds rate by 25bps on March 15 was of little surprise – less surprising, perhaps, than the eye-popping stats of Gonzaga’s ability to keep possession of the ball or some of the upsets!

Topics: Financial and Demographic Trends Affecting the Mun, Commentary

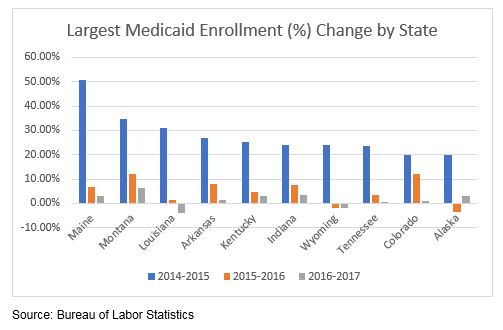

This week we look at how State GDP (and therefore employment and tax receipts) may be impacted should certain campaign promises be kept. As we prepare for the inauguration of President-Elect Donald Trump, thankfully we have been spared “fighting in the streets.”[1] However, municipal market participants are bracing for uncertainty as the Trump administration and the newly elected Congress begin the process of implementing policy ideas promised during the campaign such as repealing the Affordable Care Act and increasing infrastructure spending.

Topics: Legislation, Politics and the Bond Market, Commentary