Given many recent positive economic indicators, one might conclude that we are well beyond the housing bubble that shocked the markets in 2008. College graduates from the class of 2017 are most likely settling down in their newly acquired jobs and, unlike many of their slightly older peers, living independently and free of the fear of Mom and/or Dad harping “Just get a job!”

The Dow is hitting record highs and housing prices are up across the country (with the slight exception of Delaware and North Dakota – so close, but numbers don’t lie):

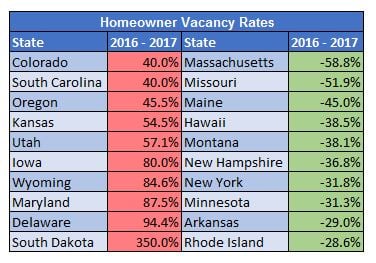

While the larger picture may be rosy, a closer view may be less welcoming. While it is true that housing prices nationwide have climbed over the last year, other indicators are pointing at potential troubles ahead. Recent data on Homeowner Vacancy Rates[1] are one such indicator. Homeowner Vacancy Rates over the last year (Q1 2016 to Q1 2017) are up 40% or more in some States (although, as noted in the chart below, there are at least ten States where the vacancy rate has significantly declined):

The chart above highlights those States presenting the most concerning data as well as those with improvement. For example, Colorado notched a 10.7% increase in housing prices but a 40% increase in the Homeowner Vacancy Rate. Similarly, South Dakota recorded a positive increase in housing prices of 5.63% but a huge increase in the Homeowner Vacancy Rate of 350%.

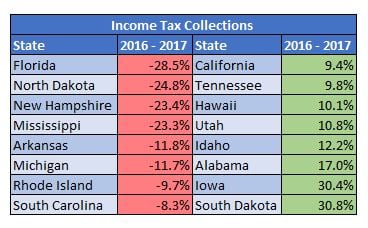

While such vacancy rate increases are only one indicator of potential trouble, other indicators, such as the total of income taxes collected by each state, also present concerns. The change in Income Tax Collections[2] over the previous year (from Q1 2016 to Q1 2017) reveals a decrease of more than 20% in four States:

While the data in the above chart highlights those States experiencing a decline in total Income Tax Collections, this data coupled with the data from the previous charts, highlights States that may be on the brink of significant downward spirals. For example, Mississippi saw a relatively anemic increase in housing prices of 1.5%, but also a 21.1% increase in the Homeowner Vacancy Rate, as well as a more than 20% decrease in Income Tax Collections. So, too, fares South Carolina, which saw a modest increase in housing prices of 3.4%, accompanied by an increase of 40% in the Homeowner Vacancy Rate and a decrease in Income Tax Collections of more than 8%.

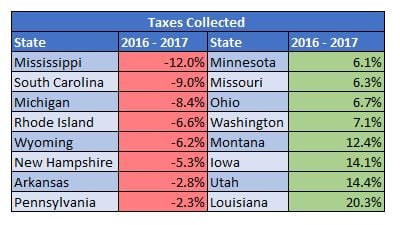

Finally, if one looks beyond just Income Tax Collections and focuses on all taxes collected, indications are that economic activity may be slowing in some States. The overall change in Taxes Collected[3] over the previous year (from Q1 2016 to Q1 2017) decreased by over 6% in five States:

Again, Mississippi and South Carolina are at the forefront of those States presenting troubling data, as each of them reported a decrease in overall tax receipts of 9% or more.

Overall, these indicators suggest that not everything in the economy may be as calm as it otherwise may seem. Housing prices across the board are up (“bubble” concerns) but tax receipts (both income as well as overall tax collections) are declining in some places. Declining income tax may likely be a sign of declining wages (overall), which means that perhaps fewer people can afford a new home with housing prices on the rise. Could those places identified with declining tax receipts be first up for popping the bubble?

Food for thought – and a reminder that the details matter.

Have a great week.

[1] The percentage of residential housing units that are vacant and for sale

[2] The percent change in value of State Gov't income tax collections,

[3] The percentage change in value of State Gov’t overall tax collections.