Amazon recently announced that it has whittled the list of contender locations for its second headquarters (HQ2) from 238 down to 20. Stamford, CT (home to Lumesis) sent a proposal, but unfortunately did not make the cut. That got us thinking that we might be able to provide Amazon some guidance based on the wealth of data we have on hand. Looking at 19 of the 20 locations (we do not have comparable data for the lone Canadian city, Toronto), below we use a variety of metrics that we believe may be important to Amazon in their decision-making process.

As you likely know, Amazon expects to invest more than $5 billion and hire 50,000 people. This will inevitably be followed by economic multipliers for the surrounding geographic areas. It makes sense why so many municipalities went to great lengths to attract Amazon. Tucson, AZ sent a 21-foot cactus. Stonecrest, GA voted to deannex 345 acres of land from the city and rename it “Amazon.” Primanti Brothers sandwich shops in Pittsburgh, PA promised a free sandwich to every Amazon employee upon arrival. Pittsburgh is still in the running, so if any Amazon executives are Yinzers, this may be worth at least a few million in tax incentives.

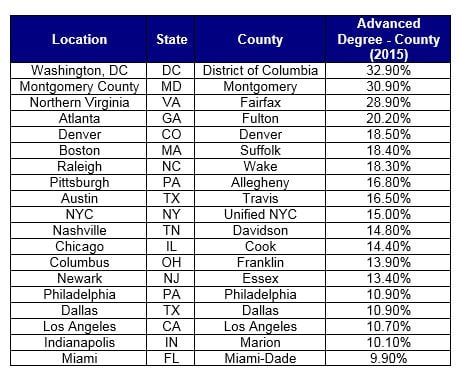

Amazon has selected major metro areas per their stated criteria. It is important, however, to have access to the right people. Let’s look at some demographic figures that get below the top-level population figures. The labor pool will be wider than simply the city in which Amazon is located, so county-level data will be used for most of this exercise.

Los Angeles County leads the way with the largest labor force (5.2 million) followed by the unified five boroughs/counties of New York City (“NYC”) with 4.2 million. Both cities have seen their labor force grow over the past year (1.7% and 2.2%, respectively). Cook County (Chicago), Dallas, and Miami-Dade are the only three other counties in the top 19 (again, sorry Canada) with labor forces over 1 million. The smallest labor forces are found in Boston, Denver, Atlanta, Indianapolis, Nashville and Newark’s home counties, each under 500,000.

The makeup of the available labor will also be key. Amazon can be expected to hire professionals with backgrounds and qualifications of all sorts, so here we look at the percentage of county residents with an advanced degree.

The greater Washington, DC area leads the way in terms of workforce educational attainment. Miami-Dade and Marion Counties, on the other hand, may lack the type and level of talent that Amazon will demand. Of note, while 15% of the residents of NYC have an advanced degree, 28.5% of those residing in Manhattan currently hold an advanced degree. As with other data points, in this analysis NYC is proving to be a creature unlike any other.

Amazon has been criticized for a number of things during their tenure in Seattle, not least of which is the added traffic and increased commute times that have followed its expansion over the past decade. Average commuting times across the 19 American locations on the list are quite similar, ranging from a low of 22 minutes in Franklin County, OH (Columbus) to a high of 33.7 minutes in Montgomery County, MD. These figures do not consider those commuting from outside the referenced county. As many people from Connecticut, New Jersey, and Long Island can attest, NYC -related commutes are often much longer than the reported 32.5-minute average for NYC residents. All else being held equal, the “Amazon Effect” on transportation and commutation will likely be felt less in larger cities.

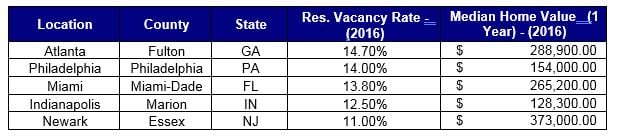

In addition to drawing on the local labor pool, Amazon can be expected to attract talent from around the globe, bringing many new families to whichever city they choose. In Seattle, Amazon has also been criticized for driving up housing costs and effectively pricing out middle- and low-income residents. In an attempt to head off this negative press, the company may look at markets where housing is readily available. Top five residential vacancy rates are listed below.

Available housing is important, but residents must be able to afford it. Atlanta, Miami, and Newark all have large housing inventories, but the median home value in those counties is each above $260,000 (see the above table). Philadelphia and Indianapolis have a great number of available residencies at more affordable prices.

Still, no clear leader has emerged, with Washington, DC having a human capital advantage and the largest metro areas on the list having the most available workers and least commuting disruptions. Some areas not highlighted in the first part of the analysis as having the native qualities necessary may in fact have housing stock more suitable to a large influx of workers and their families.

Perhaps Amazon will be enough of a draw that they can attract workers no matter where they go and no matter what the housing market looks like. In that case, management will consider their own costs of doing business: taxes and wages. Here are the 5 counties with the lowest per capita personal income figures from 2016. The lower the wages are across a geographic area, the less Amazon will have to pay for comparable services. Again, because of the breadth of positions Amazon will be looking for, we are focusing on across the board figures, rather than one job classification.

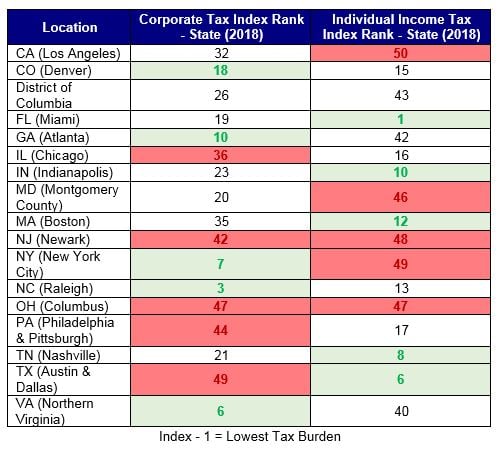

Below, I highlight the corporate and individual income tax indices for the sixteen states and Washington, DC that made the shortlist. The least and most burdensome tax rates are marked in green and red, respectively, with a value of one equaling the lowest in the nation.

There is a distinctively southeastern flair here, with North Carolina, Florida, and Tennessee having the lowest combined tax burdens in this relative ranking. Part of any incentive package will almost surely be corporate tax credits, but the amount of individual income tax that Amazon’s employees will have to pay will influence what wages they demand. Florida and Texas are leaders on that front. Interestingly, the five states with the most burdensome personal income tax structures all made this short list. What we do not yet know is what changes, if any, states will enact following the recent change to the US tax code.

There are several asymmetric factors at play here as well: things that crunching some numbers will not show. Amazon already has their first headquarters on the West coast. Geographic diversity may be a factor, perhaps negatively impacting Denver and Los Angeles’ chances. Amazon has many regulatory battles to fight, will the greater Washington, DC area seem helpful in those efforts? Perhaps a suburban campus in this area seems attractive, but Amazon would be remiss to forget that General Electric just abandoned their suburban Fairfield, CT headquarters in favor of Boston, MA in a bid to better attract talented employees. Even though NYC has the labor force and ability to absorb traffic and commuting concerns, will Amazon prefer to be a big fish in a smaller pond?

Lastly, a note on discretionary economic development incentives. Economists are divided on the impact of state and local tax credits and incentives, noting that the practice is a zero-sum game on the national level and produces a race to the bottom on a more local level. Every contender in Amazon’s top 20 list will present a package bursting at the seams with these incentives. Will these giveaways pay for themselves over time? Maybe. Would Amazon have picked the same location with 5% less in discretionary incentive money? 10% less? Who knows. What we do know is that Amazon is looking to make a massive investment of time and resources and it wants to pick a place where it can flourish for decades. Workforce, livability, housing, and all sorts of factors outside of taxes will drive Amazon’s decision.

Taking all of this into consideration, my prediction is Philadelphia, PA. Indianapolis also present a strong case, with low-cost available housing, low taxes and wage demands, and major airport accessibility. Indianapolis’ labor pool, however, does not seem to be up to Amazon’s needs. Philadelphia will give Amazon access to a broad labor market (labor force of 709,000 in the 143 square mile consolidated city-county), available housing, proximity to distinguished universities, coastal diversity among headquarters locations, and major airport access. Philadelphia is the sixth largest city in the county by population – its 1.6 million residents more than doubles Seattle’s 700,000 – and the fourth largest on the shortlist, meaning the commuting disruption should be minimal. Additionally, and unlike Indianapolis, it would place them smack in the middle of the Acela corridor, giving easy access to both NYC and Washington, DC. Pennsylvania state corporate income taxes are high, but the recent reduction in the federal corporate income tax will offset that marginal impact and a manageable individual income tax, paired with a relatively low per capita personal income, will not drive outsized wage demands.

For what it’s worth, everybody here at Lumesis disagrees with me. Our co-founders like Newark, NJ and either of the DC suburbs. The data team guesses ranged from Los Angeles, to Dallas, to Nashville to Atlanta and about half of the locations received at least one vote in my internal company-wide poll. I invite you to poke around the wide range of data available across the DIVER platforms like I did and see what you can do to make an informed prediction.

Have a great week,

Jeremy Stull, Senior Data Analyst and

Gregg Bienstock, CEO and Co-Founder