With the recent Supreme Court decision overturning the Professional and Amateur Sports Betting Act of 1992, many state governments are changing their laws to allow for legalized betting on professional sports leagues. While sports’ betting was already legal in Nevada, Delaware and New Jersey have now quickly passed and implemented legislation to legalize sports betting. As many as 16 other states including New York, West Virginia, and Mississippi are also working on passing legislation to legalize sports betting.

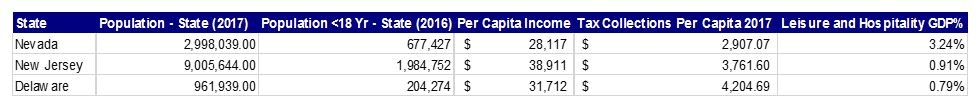

Let’s now look at some data regarding Nevada, New Jersey and Delaware that all have legalized sports betting. While comparisons among the states are difficult because of variances in per capita income, population and dominant economic industries, we can look at Nevada which has had legalized sports betting for decades to possibly make some predictions about how changing legislation will impact New Jersey and Delaware.

As we can see, Nevada has a much larger tourism sector than New Jersey and Delaware so the impact of sports betting in those states probably won’t have similar economic effects. While all the states have similar proportions of people of legal gambling age, Nevada has had a major advantage of being a larger state and a vacation destination for people looking to gamble. Delaware and New Jersey may now have to compete for tourists interested in travelling for betting on professional sports.

Estimates for increased revenue from taxes on sports betting are also relatively modest for both New Jersey and Delaware. New Jersey is estimated to bring in $17 Million (1) in additional revenue from sports betting from an 8.75% tax at brick and mortar casinos and a 13% tax for bets placed online. Delaware meanwhile is estimated to bring in an additional $5 Million (2) in tax revenues from sports betting. In the case of New Jersey, which just passed a $37.4 Billion budget that includes a pension shortfall of $2.5 Billion, this is clearly a very modest increase in revenue. These revenues amount to an additional $1.89 per person in New Jersey and $5.20 per person in Delaware from taxes on sports betting.

As the landscape around sports betting changes, states will also have to determine how to tax gambling, what rates to set and whether to distinguish between online and in-person betting at casinos. Like the impact of marijuana taxes (which are also in the process of changing in certain states) states may end up competing with each other in order to attract gamblers and tax revenue impacts may be unpredictable. For example, Pennsylvania is also looking at legalizing sports gambling and is proposing a 34% tax rate on bets in casinos and, as a result, may have modest revenue gains due to the proximity of Delaware and New Jersey with lower tax rates. States will also have to negotiate with the various professional leagues that will certainly want a portion of revenues from gambling.

There are many issues surrounding sports betting in the United States that will keep municipal market participants interested in the coming months and years. So, in the meantime keep your eyes open for new legislation at the state level and look at the odds for which teams can win you some money. Personally, I will be playing it safe and sticking to the roulette table. (3)

Have a great week,

Eli Molin and Gregg Bienstock

- http://www.governing.com/topics/finance/tns-sports-betting-jersey.html

- https://www.bloomberg.com/news/articles/2018-06-05/delaware-beats-new-jersey-to-single-game-bet-starting-line

- Where the author won $50 this past weekend in Tahoe.