This week we bring you the July 2017 DIVER Geo Scores and highlight a data point of concern – wages. We also look at home ownership rates over the past quarter and year. As regular readers know, I have expressed ongoing concern over housing prices. Jane and Julie thought it would be interesting to test my concerns against home ownership rate data.

DIVER Geo Scores are designed to quickly communicate the overall economic health of a selected geographic area on a scale of 0 to 10. The Geo Score reflects the relative economic well-being of the location and is available for all States, counties, and approximately 350 of the largest cities. Calculations are released monthly and are based on multiple, meaningful economic and demographic data from the employment, income and housing categories.

Top/Bottom Movers at the State Level

The tables below highlight those States with the most meaningful moves (positive and negative) year on year. For the top States that had the most significant increases in their Geo Scores, the focus is on the top 11 (there was a tie at +0.8 amongst five States). Of our top 11, all saw improvement in their employment pictures with declining unemployment, improvement in the poverty rate and continued improvement in housing on both the foreclosure side as well as housing prices.

Despite strong improvement in their Geo Score, all States but Washington saw a decline in wages. This is a worrisome data point that will carry through other parts of this commentary. Our concern is further emphasized by the BEA’s August 1 release of personal income data for June (at the national level) which also showed a decline while also showing an increase in personal consumption expenditures. And the Fed is worried about inflation!

For bottom movers at the State level, our focus is the bottom 14 (similar to top movers, there was a logjam of States that saw their Geo Score decline by 0.6). Of the bottom 14, surprisingly, most saw relatively stable employment pictures while all saw a decline in wages. Delaware, Connecticut and Iowa stood out with declines in the most data points contemplated by our Geo Score. As noted in prior months, despite seeing declines in their Geo Score, all but Connecticut saw rising housing prices, further fueling my concern that housing prices are frothy (more on this shortly).

County Level Geo Scores

At the county level, most top Geo Score increases year on year saw improvements in employment data, whereas five of our top 11 (due to the tie) saw declining wages (a slight variation from the State level wage data). All saw an improving housing picture with all but Mercer County, NJ seeing increases in housing prices.

Among counties with the greatest decline in their Geo Score over the past year, all but Carbon, UT, Warren, NJ, Peoria, IL and Gates, NC saw deteriorating employment conditions, and all but Covington, VA saw a decline in wages. For each county in our bottom movers, all saw an increase in foreclosures but simultaneously saw housing prices on the rise, further highlighting my concern about the housing market.

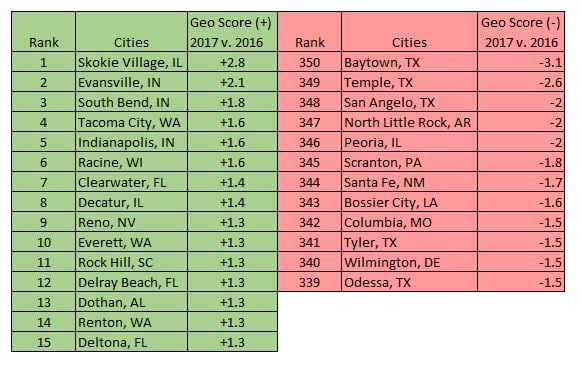

City Level Geo Scores

At the City level, most cities with the greatest increase in their Geo Score year on year (we use the top 15 as the result of a tie at 9) had improved employment and housing conditions – the exceptions being South Bend, IN and Decatur, IL on the employment side and Racine, WI and Decatur, IL on the housing side. Of concern is the mixed bag on the wages side with 8 of the top 15 seeing a decline in wages. A shout-out to the Hoosier State (this is for the Lumesis Hoosier State contingent) for a strong showing.

For cities with the greatest declines (using the bottom 12), Texas (again) dominates our bottom movers with five of 12. Almost all saw deteriorating employment pictures and all but Temple, TX and Columbia, MO saw declining wages. Despite deteriorating economic conditions, all saw increases in their housing prices. In fact, of the bottom 25 movers, all but four saw increasing housing prices. See below for our review of prices vs. home ownership rates.

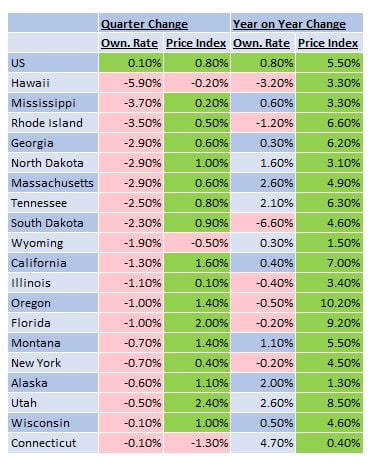

Home Ownership Rates and Housing Prices – Any Correlation?

Periodically, we look for data correlations our readers might find useful. Last week, Jane and Julie brought to my attention new data regarding home ownership rates and thought it might be interesting to see how the same have fared, given my persistent concerns about housing prices. One would think that there would be a correlation between the home ownership rate and housing prices – if the ownership rate is down, prices should reflect the same and the opposite holding true.

Due to data availability inconsistencies, we used the home ownership rates for Q1 and Q2 for 2017 and Q2 for 2016. For housing prices, we used the most recent index and corresponding periods – Q1 2017, Q4 2016 and Q1 2016. We kept this simple, but you certainly can contemplate other data points to compare and contrast (housing supply, historical price movements [think housing bubble], wages, tax rates, employment data, etc.).

What did we find? For starters, over the last quarter, 20 States saw a decline in their home ownership rates while all but three – Hawaii, Wyoming and Connecticut – saw an increase in housing prices. Of those 20 States, seven also saw a decline in the home ownership rate over the one-year period while all saw an increase in housing prices. As noted, this is a limited comparison, but one my colleagues thought meaningful enough to test my concern regarding housing prices. I continue to have my concerns about housing and wages and may look to add to this analysis in the coming months.

Have a great week.

Gregg Bienstock and Jane Ma