Hello Everyone, while there is a lot to cover on current events including tariffs with China, Paul Ryan going back to Wisconsin, and the supposed death of attorney-client privilege, this week here at Lumesis we thought it would be appropriate to look at marijuana sales tax revenues at the state level. While we won’t state whether we did or “didn’t inhale[1],” or if good people do or “don’t smoke marijuana[2],” or if we are simply “holding it for a friend[3],” we decided it would be better that if we were going to talk about this better to do so here rather than “somewhere else where something bad could happen[4].”

Currently eight states along with the District of Columbia have legalized marijuana for recreational use, with legalization for recreational use set to be implemented in Vermont later this year. In addition, 22 states, including Minnesota[5] allow for medical marijuana use. With the new tax reform bill limiting the state and local tax deduction, states may look for other sources of revenue including legalizing and taxing marijuana to substitute potential revenue losses from property or other tax increase that citizens of high tax states might now oppose due to the inability to deduct the tax payments from their federal income taxes.

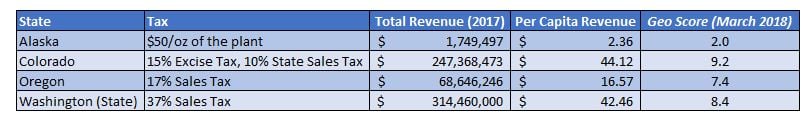

In the table below, we present data on the four states -- Alaska, Colorado, Oregon, and Washington -- where recreational marijuana sales were legal for all of 2017 along with our proprietary Geo Score.

As we can see, tax rates and revenue per capita vary widely between these four states. It is interesting to note that the states with the highest[6] Geo Scores also had the most per capita revenue on marijuana sales (we are not suggesting there is a correlation between the two). The above table does not include data on all states with legalized recreational marijuana including Nevada and California (legalized marijuana has not been sold and taxed for a full year), Maine (which has yet to implement rules for marijuana growers and sellers), and Massachusetts and Vermont (where the legalized marijuana won’t be available for sale until later this year).

The impact that legalized marijuana has and will continue to have on state budgets could undergo radical change if states and the federal government change their policies on medical and/or recreational marijuana. In Colorado, for example, the state has the “first adopter” advantage and an enormous advantage because its residents must travel quite far if they want to acquire legal marijuana elsewhere. Whereas Massachusetts, Maine, and Vermont, which are smaller in size and near each other, will have to compete, to some extent, for marijuana sales (and for sales to citizens of neighboring states). As evidence of this, Massachusetts is set to implement a 3.75% sales tax on marijuana sales and legalization cannot be expected to have the same effect on its state coffers as Washington which has a 37% sales tax on marijuana sales. Why any state legalizing recreational sale of marijuana wouldn’t follow the lead of, at a minimum, Colorado is open to debate.

One reason may be the fear that higher[7] tax rates may drive consumers back to the underground market as opposed to buying marijuana through regulated retail locations. As the Tax Foundation notes “Colorado, Washington, and Oregon have all taken steps to reduce their marijuana tax rates[8],” these states marijuana tax rates range from 17% in Oregon to 37% in Washington, while Massachusetts with its lower marijuana sales tax will be less likely to drive consumers to purchase marijuana through other methods.

Of course, one major issue states face with marijuana legalization is the fact that it remains illegal on the federal level and the current and previous administration have had differing policies on enforcement of federal statutes surrounding marijuana. As the legal and regulatory environment surrounding marijuana possession, sale and consumption in the United States changes we will learn more about its impact on state and local government budgets and the municipal marketplace.

Have a great week,

[1] Former President Bill Clinton

[2] Attorney General Jeff Sessions

[3] Millions of high school students to their parents

[4] What cool parents say

[5] Where residents with a prescription can see two types of “Northern Lights”

[6] No pun intended

[7] Again, no pun intended

[8] https://taxfoundation.org/marijuana-taxes-state/